American Life Broker

Call us! 770-525-0550

Life insurance should

be affordable.

Peace of mind for the price of a nice dinner. In just ten minutes, you could qualify for a policy

that could protect your family for decades

No medical exams, blood tests or rate increases

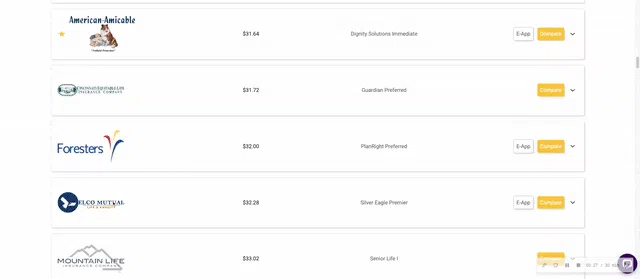

Coverage by Great Companies

What is included in a

whole life insurance

policy?

Guaranteed coverage that lasts for the rest of your life with no medical exam

Locked-in premiums that are guaranteed not to increase and coverage that will never decrease.

Potential cash value that grows

A set benefit to be paid to your designated beneficiaries at your death

Coverage by Great Companies

No medical exams

To be covered all you have to do is answer a few health questions instead of setting up medical exams and blood tests.

Same-day coverage

Because of our expedited process, most customers enjoy same-day coverage. That means you can go from applying to protecting your family in a matter of minutes.

Affordable prices

You can tailor your policy to fit your budget and needs because we believe life insurance isn't a one-size-fits-all solution for your family. Get the policy that's best for your family today.

Whole life coverage may be right if you:

Have a tight budget

Want to lock in rates

Avoid medical exams

Coverage won't expire

Coverage to pay funeral

Simple, Secure and Fast

Get coverage in 3 easy steps:

Get a quote

To get a life insurance quote, simply answer a few questions about your health and see the estimated costs for various policy options.

Apply in minutes

The application process is fast and straightforward - you can get insured in about 10 minutes

Instant-approval

With instant approval, you don't need to fill out multiple forms, get a medical exam or wait a month to find out if you're approved.

Frequently Asked Questions

Looking for more info? Here are some things we're commonly asked

What is the difference between whole life and term life?

Like whole life plans, most term life plans have a fixed premium and fixed death benefit. However, whole life provides benefits for the rest of the insured person’s life, whereas term life only lasts for a specific period of time. In addition, a whole life policy includes cash value, whereas a term life policy only includes the death benefit. On the other hand, term life has a lower premium per dollar of coverage and significantly larger death benefits are available.

Why should I work with American Life Brokerage?

We truly have your best interest at heart. Having access to over 20 'A+' rated insurance companies means we have access to various policies from different life insurance companies and can help you find the best coverage at the most affordable price.

Simply put, we work for you not the insurance companies

How much does whole life insurance cost?

In general, whole life is a highly affordable type of insurance, and the premium will never increase. Your premium takes into account your current age at the time of issue, your gender, and your death benefit amount.

How do I know my policy is reliable?

American Life Broker works with top life insurance carriers. We only offer policies backed by established industry leaders.

What are my veteran benefits for funeral costs?

The U.S. Department of Veterans Affairs could help pay for your burial if you are a veteran. If the death is not service-related, your family could receive a $300 burial allowance as well as $807 for a plot. Surviving loved ones can receive $2,000 for a service-related death. Veterans can also receive a gravesite and headstone in a national VA cemetery for free.

per The U.S. Department of Veterans Affairs

https://www.benefits.va.gov/compensation/claims-special-burial.asp

Will Social Security pay for Funeral Expenses?

The Social Security Administration (SSA) pays a small grant to eligible survivors of some beneficiaries to help with the cost of a funeral. In 2020, this amount was set by law at $255 for SSI recipients.

The heirs of a beneficiary who has passed have some flexibility in how this benefit is paid out and what it may be used to pay for.

per the Social Security Administration

American Life Broker is a referral source that provides services to match consumers with companies that may provide certain insurance coverage to them. American Life Broker does not make decisions about insurance coverage that may be available to you. American Life Broker doesn’t promise a specific outcome or results.